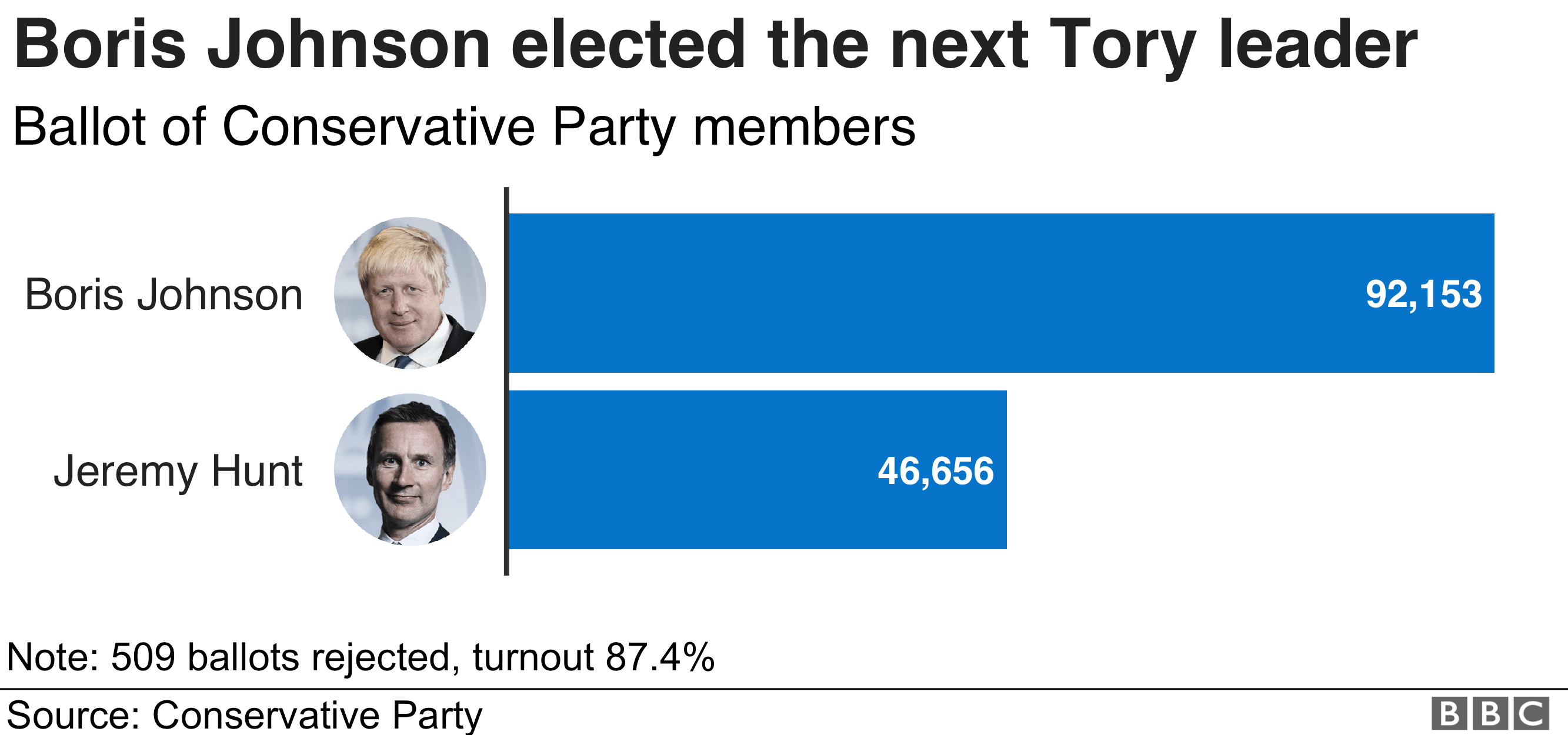

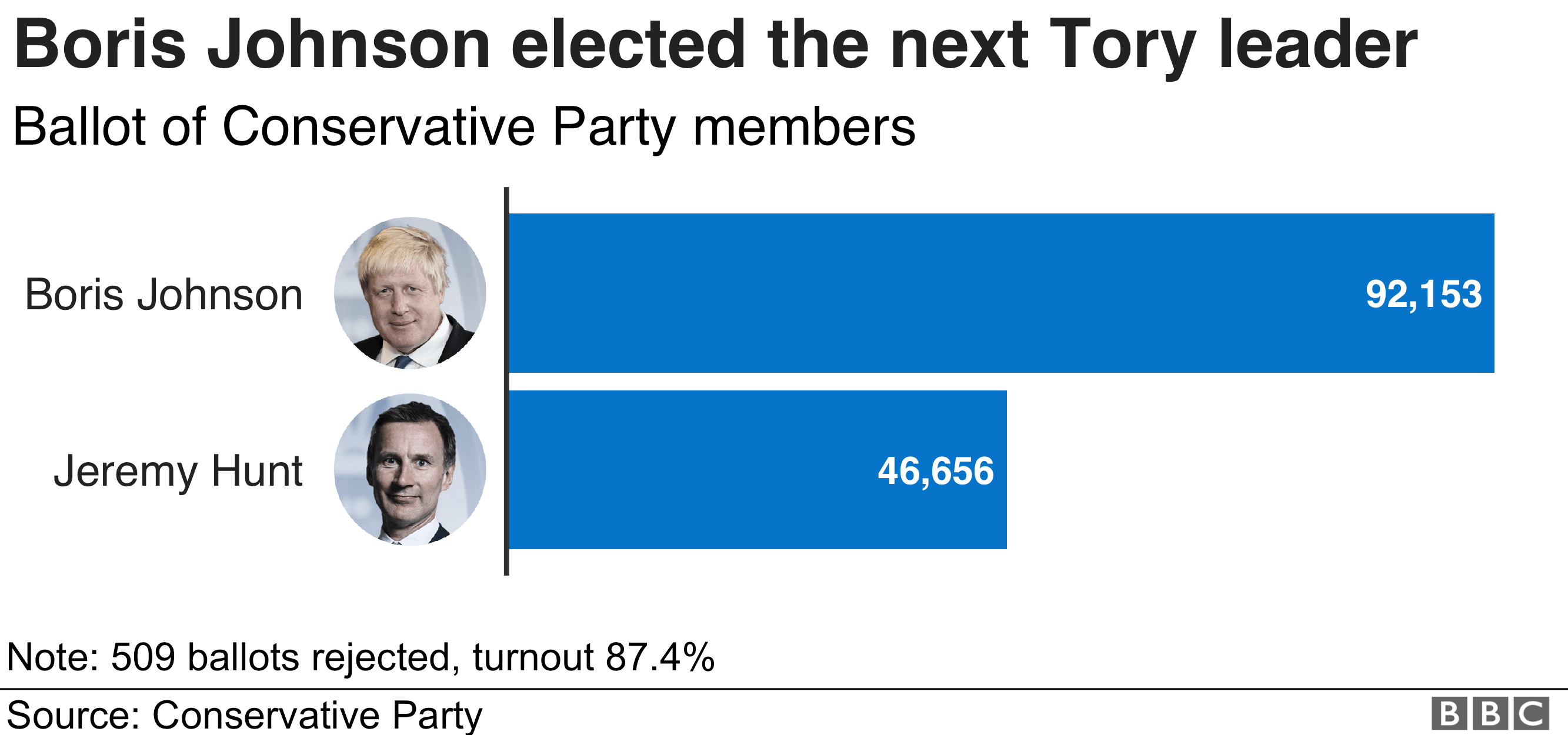

Boris Johnson has been elected new Conservative leader in a ballot of party members and will become the next UK prime minister.

He beat Jeremy Hunt comfortably, winning 92,153 votes to his rival's 46,656.

The former London mayor takes over from Theresa May on Wednesday.

In his victory speech, Mr Johnson promised he would "deliver Brexit, unite the country and defeat Jeremy Corbyn".

… President Donald Trump … sent his congratulations to Mr Johnson, tweeting: "He will be great!"

The

new prime minister of the United Kingdom used to be… an American — yes, that's right: the man who moves into 10 Downing Street on Wednesday used to be a citizen of the United States.

To be more specific, Boris used to have dual citizenship. That was before the

former foreign minister was hounded

for so long by America's IRS that,

in disgust during his tenure as mayor of London, he renounced his dual American citizenship in 2015. (Cheers to Instapundit for

the Instalink e obrigado para OT.)

As

The Economist reported in February 2015,

BORIS JOHNSON, [then] the mayor of London, is British-American by birth—and by

temperament. He mixes the can-do frontier spirit with self-deprecating

wit. After being sacked as a shadow cabinet minister, he said: “There

are no disasters, only opportunities.

And, indeed, opportunities for

fresh disasters.” He is relentlessly optimistic. “Voting Tory will cause

your wife to have bigger breasts and increase your chances of owning a

BMW M3,” he once promised.

And, indeed, opportunities for

fresh disasters.” He is relentlessly optimistic. “Voting Tory will cause

your wife to have bigger breasts and increase your chances of owning a

BMW M3,” he once promised.

Yet Mr Johnson (pictured) is so fed up with the Internal Revenue Service

(IRS) that he is renouncing his US citizenship. He says he wants to

affirm his commitment to Britain—a wise move for a man who hopes to be

prime minister some day. But he has also talked of “getting a divorce

from America” because of its “incredible doctrine of global taxation”.

He became American by “an accident of birth”: his father was studying in

New York. Half a century later this made Johnson junior liable for

American capital-gains tax on the sale of his primary home, in north

London; Britain levies no such tax. He harrumphed last year that this

was “absolutely outrageous” and said he wouldn’t pay. (He later settled

for an undisclosed sum.)

The number of Americans giving up their passports has shot

up, from less than 1,000 a year in the late 2000s to a record 3,415 in

2014. A new spur is the Foreign Account Tax Compliance Act (FATCA) of

2010, which makes it a lot harder for Americans overseas to get (or

keep) bank accounts, pensions and mortgages, because foreign financial

firms don’t want the administrative hassles that FATCA throws up. The

law also increases filing requirements for citizens—and thus stokes

fears that honest mistakes will be punished.

A neighbour of this correspondent, who was born in America

but moved to Britain as a child, recently received a huge bill from the

IRS, out of the blue, for many years of unfiled taxes. He had not

realised that he owed anything; he had always paid taxes promptly in

Britain. The IRS was so aggressive that he feared he might lose his

technology business; he even discussed divorce with his wife as a way to

shield their assets. In the end, he settled for a six-figure sum. He,

too, has since renounced his citizenship.

Related

Related: •

Keeping the IRS happy grew ever more time-consuming and costly, until it became intolerable

•

A massive breach of the Fourth Amendment:

The vast majority of those renouncing citizenship are middle-class

Americans, living overseas, fully compliant with their U.S. tax

obligations

•

TaxProf's take on Prince Harry's bride, via

Instapundit, namely that

Meghan Markle’s U.S. Citizenship Could Cause Tax Headaches For British Royal Family

Moreover: Check out

46 photographs of Boris Johnson to see whether he appears more British or more American

En 1959, quand le régime de Fulgencio Batista est renversé, Che Guevara est d’abord nommé commandant en chef de la prison de la Cabaña. Dans cette forteresse, il met en place un tribunal révolutionnaire qui est à l’origine de centaines d'exécutions. Policiers, militaires et ennemis du nouveau régime y sont jugés coupables de crimes de guerre et doivent parfois justifier leur condamnation devant leur famille. Ce passage à la Cabaña lui vaudra le surnom de carnicerito, autrement dit le “petit boucher”. Mais le Che assume : "Nous avons fusillé, nous fusillons et nous continuerons de fusiller autant qu'il le faudra", déclare-t-il aux Nations Unies en 1964.